CWALL

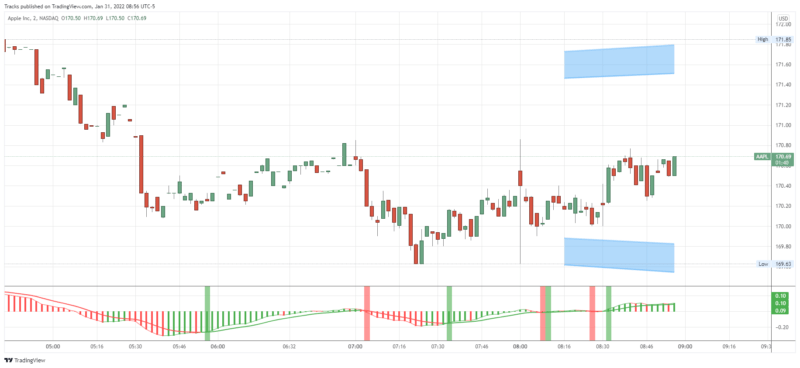

LiferTracks posted an update 3 years ago

Folks, the word today is caution. Things could be very volatile today and there is no shame in sitting out if you don’t feel comfortable. Certainly do not force trades today. Overall trend for SPY is obviously still bearish, but anything could happen after this tremendous dip. I’ll once again be watching secondary and mid level timeframes…

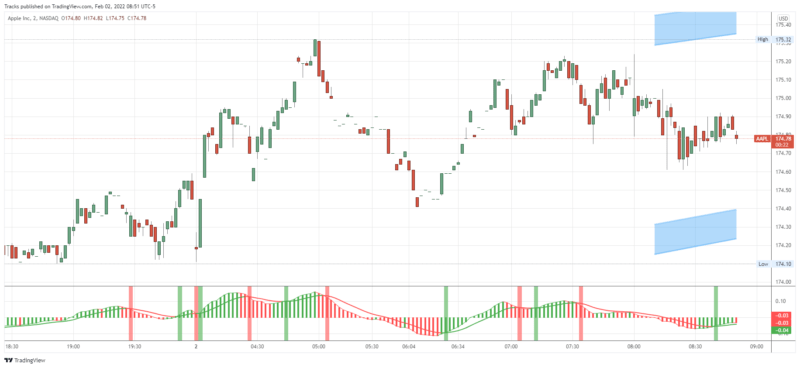

Tracks posted an update 3 years ago

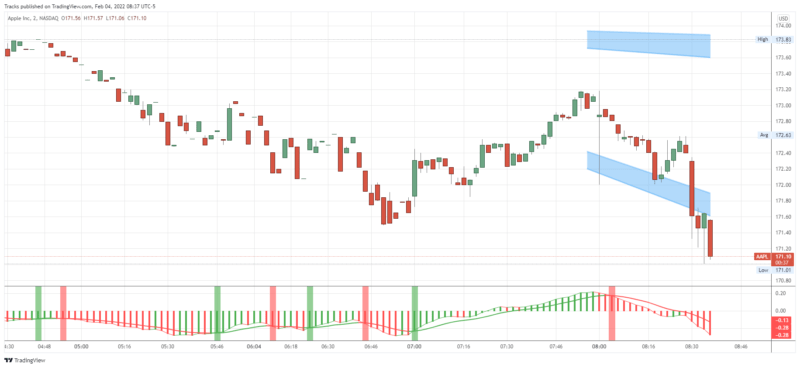

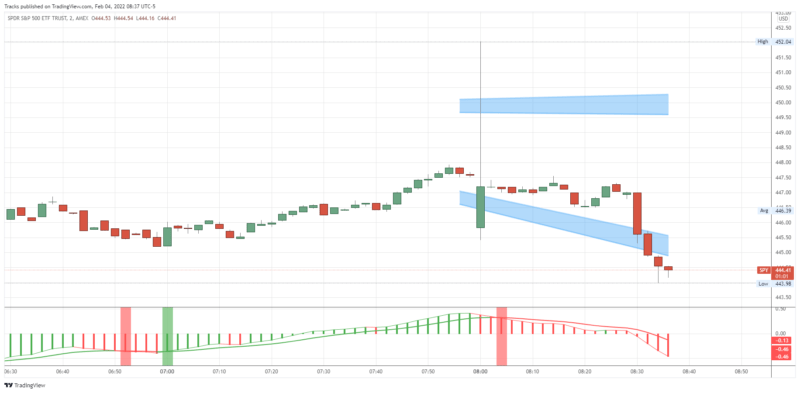

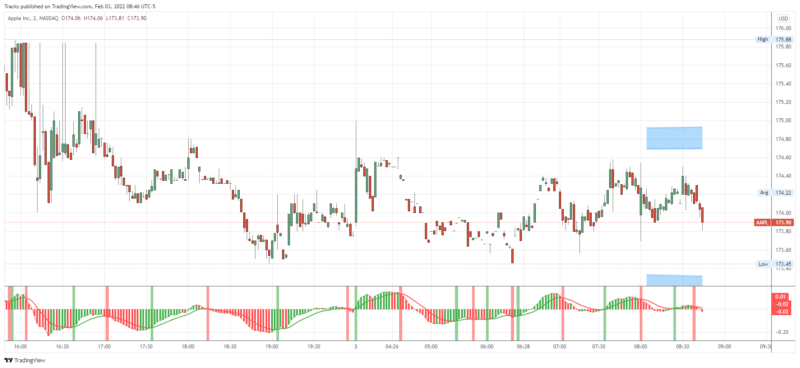

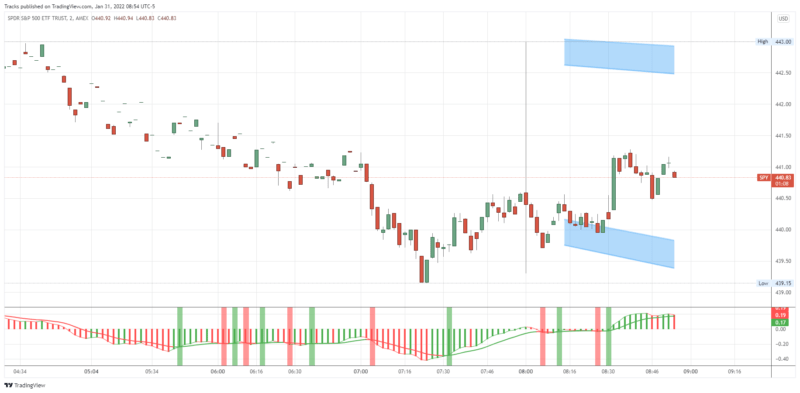

SPY got a little bump with the AMZN ER last night, but dropped back down in pre-market today. The daily 200SMA is lining up with the next level of Primary support at 443.15, so that’s our next target, then 437.85 below that, but we’re getting into a decision point. From here, it’s possible that SPY could turn bounce based on the fib…

KingJulien1 CommentYou meant SPY is testing support in the 445.65 area?

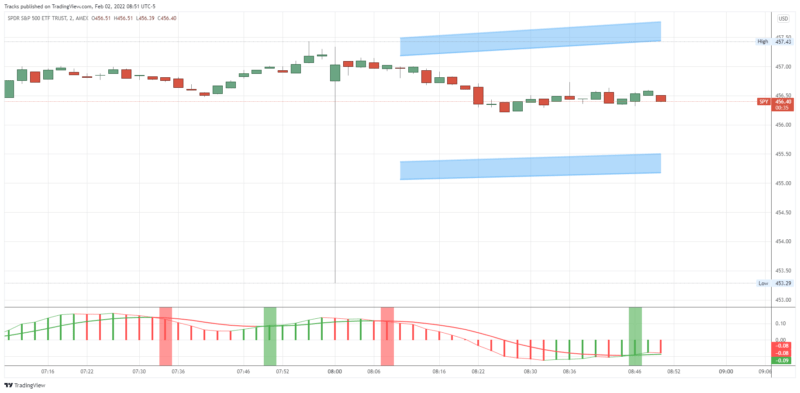

Tracks posted an update 3 years ago

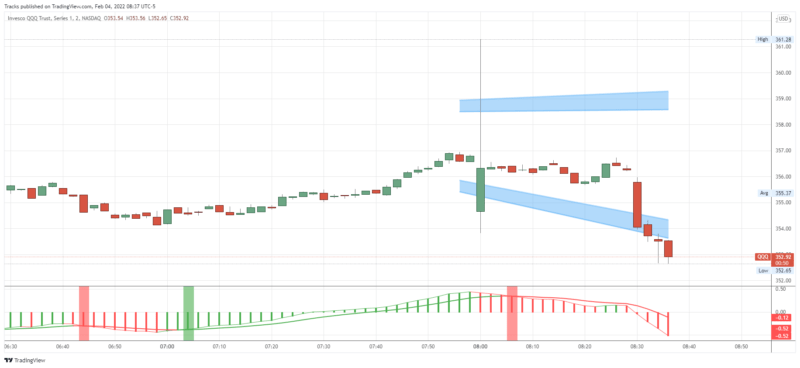

So far, SPY has not been able to break above the resistance discussed yesterday. The 4H chart is now trying to start a bear cycle, and moving below 452.80 would help drive that. Next support is at 446.80. This could be the start of the next leg down that we are anticipating. That will remain the plan unless SPY pass through resistance…

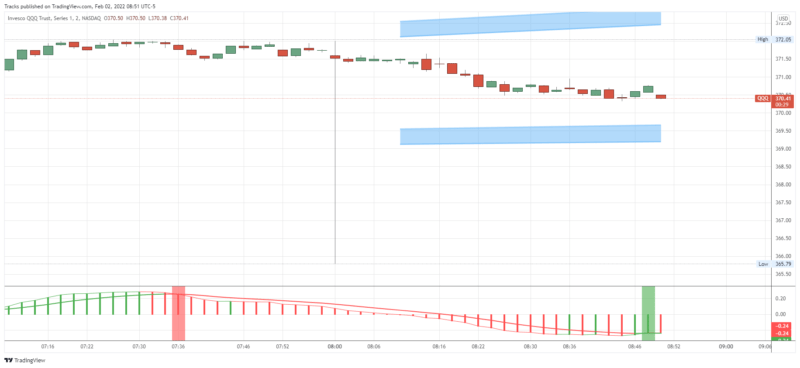

Tracks posted an update 3 years ago

After recycling those mid timeframes yesterday, SPY has run up to the next set of targets. It is now in the 61.8% retrace area of the big move down, which is ideal to start the next bearish leg. Because of this, I’ll be watching this zone intently, to see how the market moves from here. The first signs of bearish activity would be a drop…

Tracks posted an update 3 years ago

SPY showing sings it could continue up this week, with a 4H bullish cycle in play and a Daily cycle trying to start. However it is also hitting some resistance as well as the daily 200SMA. I’ll feel much more bullish if SPY can get above 444. From there, the next targets would be 449 and 456. If it can’t break that 444 level, it could…

- Load More