Kerry

LiferNurseJohn93 posted an update 3 years ago

Thursday trading plan

1. TGT

a. Looks to be at the top of the target area. 250 looks to be where I expected it to be this week. The 4 hour candle at the end of the day signals a possible a reversal from this area. Expect a drop to possible 241-245 area. So a possible short put play is in order especially if there is a weak open on it…NurseJohn93 posted an update 3 years ago

Post Easter Trade Plan

1. COST

a. Appeared to end on a bearish 4 hour candle along with possible daily turn down on the MACD.

b. Bottom of channel appears to be at 583. Expect Monday Morning trading to test that number. If it bounces expect the next move to be heading toward the top of the channel. (approximately might be 620.… Read moreWSB-Tendies-Mike, JayG7 and Mferg1 CommentGood stuff John!

NurseJohn93 posted an update 3 years ago

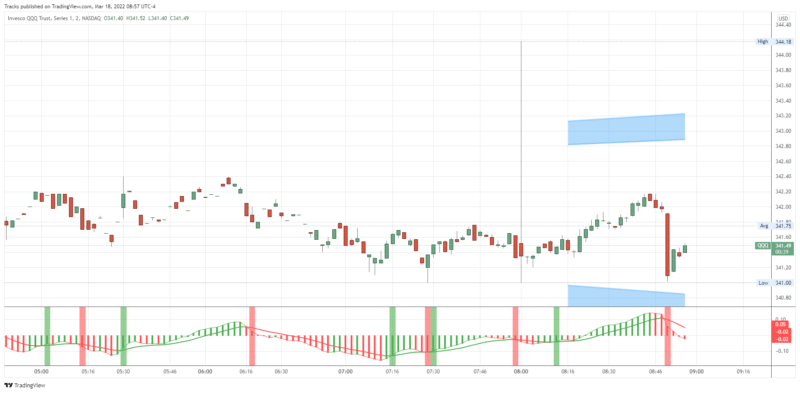

Trade plan for this week.

Expectation to see QQQ and broad tech to drop. Target is 341 to 343 area monday. Possible bounce tuesday. Small position taken out friday with puts strike at 344. Apple Puts opened as well to see another leg down as well. If hard push down, expect to close at open or early morning. Will adjust accordingly if bulls try…

NurseJohn93 posted an update 3 years ago

NIO will continue downward this week on halted production announced over the weekend. Could be a great opportunity to place put options on if possible

Tracks posted an update 3 years ago

The continued bullish moves yesterday were enough to get the weekly chart hinting at a bullish turn for the first time this year. We’ll see if it can end the week that way today. Mid timeframes gave some bearish cycles overnight, but didn’t make new lows and could turn back up this morning. I’ll look for moves up as long as SPY remains…

- Load More