Rick

LiferSteve posted an update in the group

11 months ago OP Lite 11 months ago

OP Lite 11 months agoIf you watched our live session last week you probably gained a ton Friday. If you missed it, at least you can see what you missed and why it was powerful. Don’t make that mistake again – in fact, get Secret Sauce on demand course & get the live stream every Monday, Wednesday, and Friday (month trial) if you email…

Steve posted an update 11 months ago

If you watched our live session last week you probably gained a ton Friday. If you missed it, at least you can see what you missed and why it was powerful. Don’t make that mistake again – in fact, get Secret Sauce on demand course & get the live stream every Monday, Wednesday, and Friday (month trial) if you email me today….…

Steve posted an update in the group

11 months ago OP Lite 11 months ago

OP Lite 11 months agohttps://app.optionsplayers.com/op-wire-9-9-2-lite/

app.optionsplayers.com

OP Wire 9/9 (OP - Lite) » Options Players

Last Friday, Wall Street’s major indexes closed lower due to concerns over a slowing labor market. Both the S&P 500 and Dow Jones posted their largest

Steve posted an update in the group

11 months ago OP Lite 11 months ago

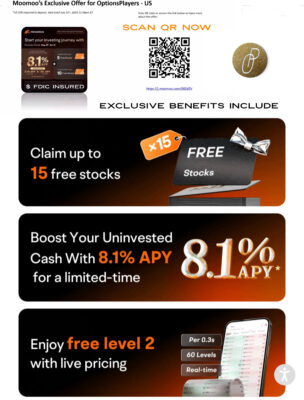

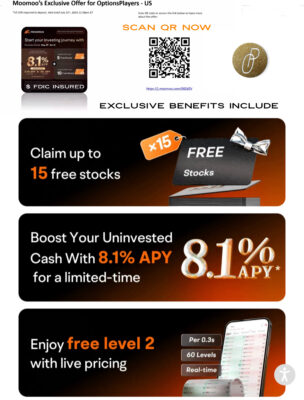

OP Lite 11 months agoYour OP Exclusive Broker Deal awaits you!

With the power of Interactive Brokers, Moomoo has offered OP members an opportunity to leverage IB and OP to stack even more gains.

Using the link here:

Or by scanning the QR code below, you receive the following benefits with your $1,000 initial deposit

💵 8.1% interest*

💵…

j.moomoo.com

Hey friends! Don't miss out on this amazing welcome rewards for new users!

Get 8.1% APY on uninvested cash and up to 15 free stocks!

Steve1 CommentForgot to mention- you can also day trade (buy and sell options SAME DAY) with your Moomoo cash account

Steve posted an update 11 months ago

Your OP Exclusive Broker Deal awaits you!

With the power of Interactive Brokers, Moomoo has offered OP members an opportunity to leverage IB and OP to stack even more gains.

Using the link here:

Or by scanning the QR code below, you receive the following benefits with your $1,000 initial deposit

💵 8.1% interest*

💵…

j.moomoo.com

Hey friends! Don't miss out on this amazing welcome rewards for new users!

Get 8.1% APY on uninvested cash and up to 15 free stocks!

Forgot to mention- you can also day trade (buy and sell options SAME DAY) with your Moomoo cash account

- Load More