Yamadawg

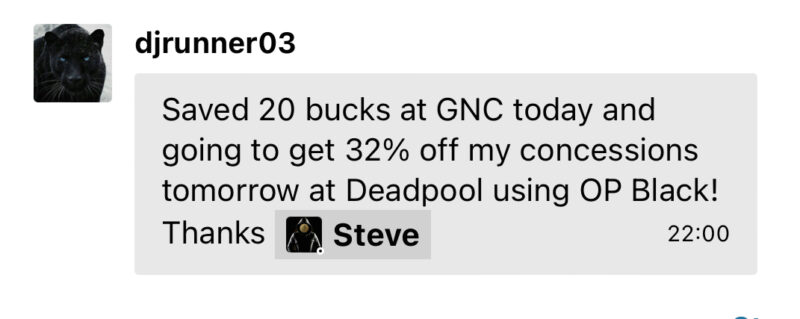

Community MemberSteve posted an update 11 months ago

Labor Day Promo

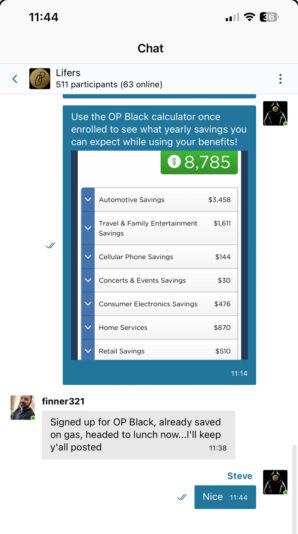

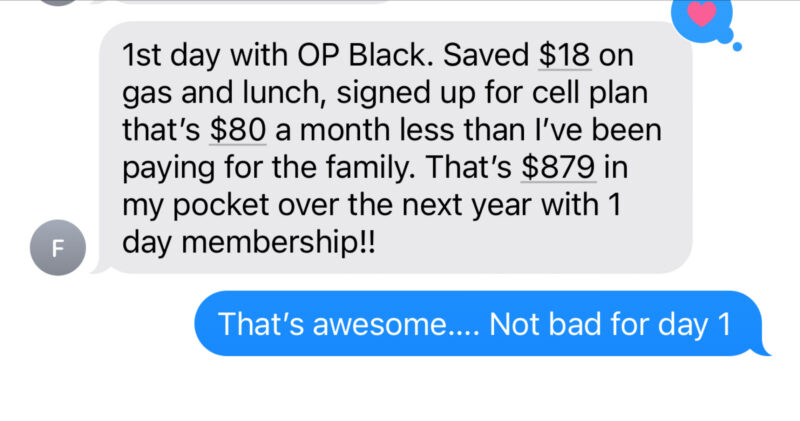

FIRST 10 to members to refer someone to OP for the FREE month trial to OP Gold will get YOU AND THE REFERRAL OP BLACK perks app access for the entire year! Just to put that in perspective, many members and I have already saved over $1k since we launched OP Black last month using the gas, food, travel, and electronics deals so…

- Load More