paulj23

Community MemberSteve posted an update 2 years ago

The recent risk rally, albeit one that has been concentrated mostly in U.S. tech stocks, has taken many by surprise, but it may be close to coming to an end, analysts say.

One of those is Jefferies’ Mohit Kumar, who says an end to the recent rally in equities – driven by a number of factors, including an agreement on the U.S. debt ceiling,…

ibechillin33, paulj23 and 3 others2 CommentsInteresting

Steve all of these are duplicates from your emails at 3am

Steve posted an update 2 years ago

2 years ago (edited)

Bearish Watchlist of Plays

(my targets for a negative response to Fed interest rate decision)

$NFLX – June 30 $410 Puts @ $ Last

$NVDA – June 30 $390 Puts @ $ Last

$TSLA – June 30 $250 Puts @ $ Last

$QQQ – June 30 $360 Puts @ $ Last

$META- June 30 $260 Puts @ $ Last

Thx Steve

Thanks Steve always enjoy the lists

Steve posted an update 2 years ago

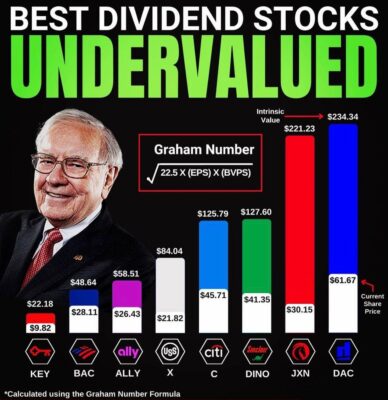

Great shopping list fir 401k long term hold type plays. Thx Steve.

Steve posted an update 2 years ago

As the clock closer to an unprecedented US debt default, the world’s second- and third-biggest economies are watching in fear.

China and Japan are the largest foreign investors in American government debt. Together they own $2 trillion — more than a quarter — of the $7.6 trillion in US Treasury securities held by foreign countries.

Beijing…

Interesting article…everyone is playing the wait and see until the negotiations are resolved (until the next time it happens). Interestingly the author focused internal consumer pullback in China but didn’t mention their own real estate loan exposure/default which could be massive in its own right. Something else to watch as it once we… Read more

Very interesting indeed.

Steve posted an update 2 years ago

- Load More