Spiderbite

Community MemberNurseJohn93 posted an update 3 years ago

NIO will continue downward this week on halted production announced over the weekend. Could be a great opportunity to place put options on if possible

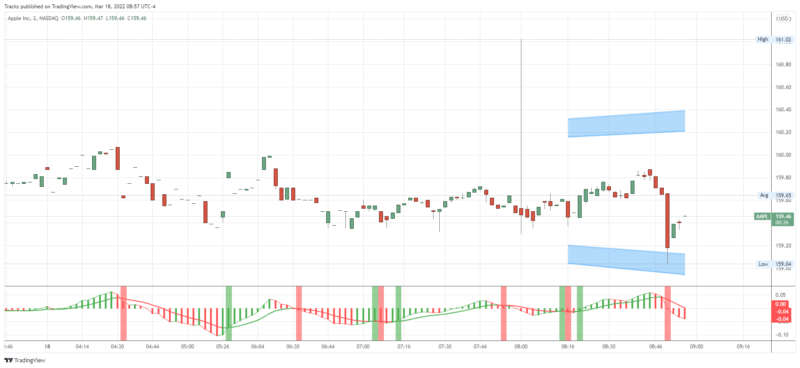

Tracks posted an update 3 years ago

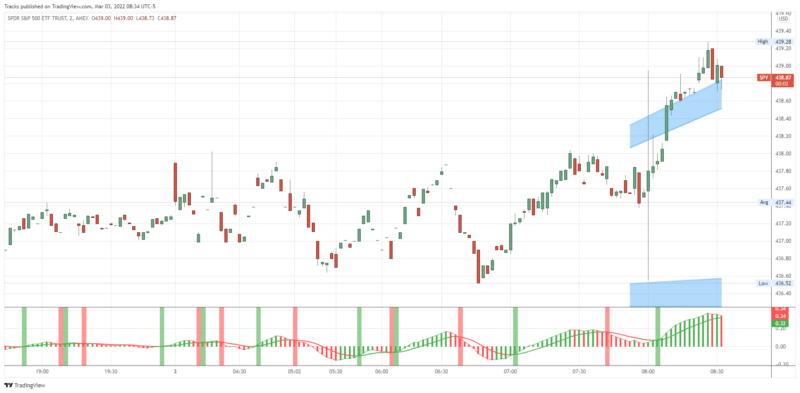

The continued bullish moves yesterday were enough to get the weekly chart hinting at a bullish turn for the first time this year. We’ll see if it can end the week that way today. Mid timeframes gave some bearish cycles overnight, but didn’t make new lows and could turn back up this morning. I’ll look for moves up as long as SPY remains…

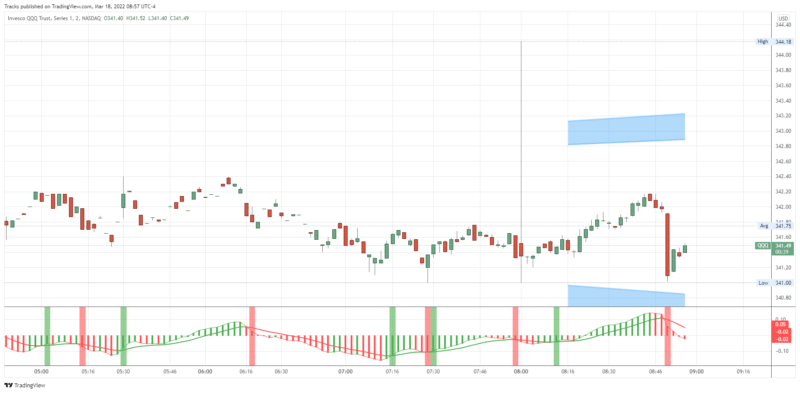

Tracks posted an update 3 years ago

The move yesterday on SPY made a higher high as it now sits around some primary resistance at 433.75. Although mid timeframes may need to recycle, the next targets up are 436.35, 437.80 and then 444. At this point it could fall back to 422 and still be bullish. Support levels below are 429.75, 427.70 and 425.75.

Mid level timeframes are…

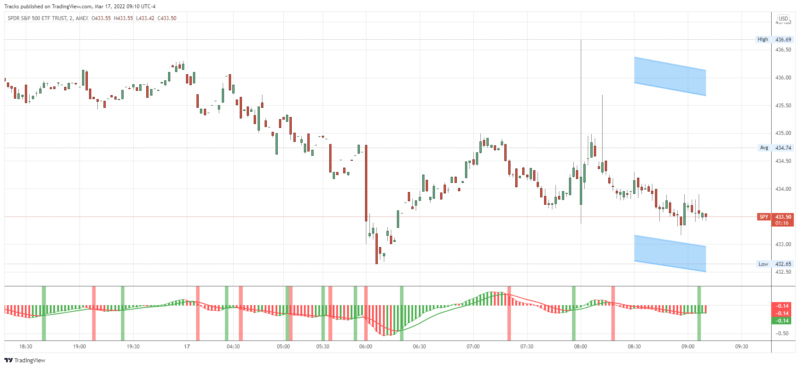

Tracks posted an update 3 years ago

SPY continued up this morning as mids carried primary timeframes into bullish cycles, as discussed yesterday. The gap up this morning gets SPY to the 430 target (which was 428 yesterday). If the Feds continue with the 0.25 interest rate hike and don’t change any plans, I expect the market to continue up (Also barring bad news from…

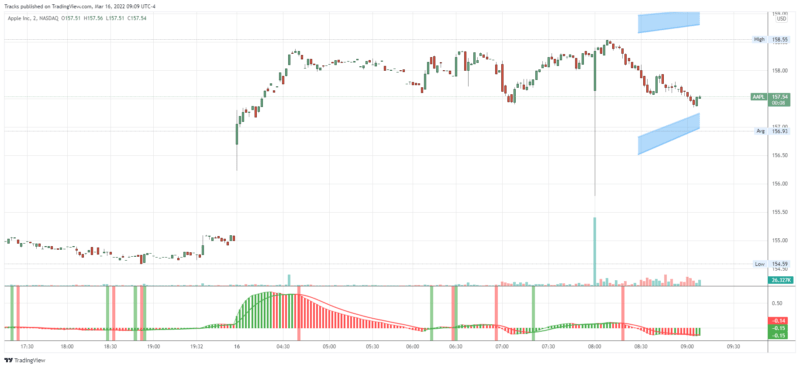

Tracks posted an update 3 years ago

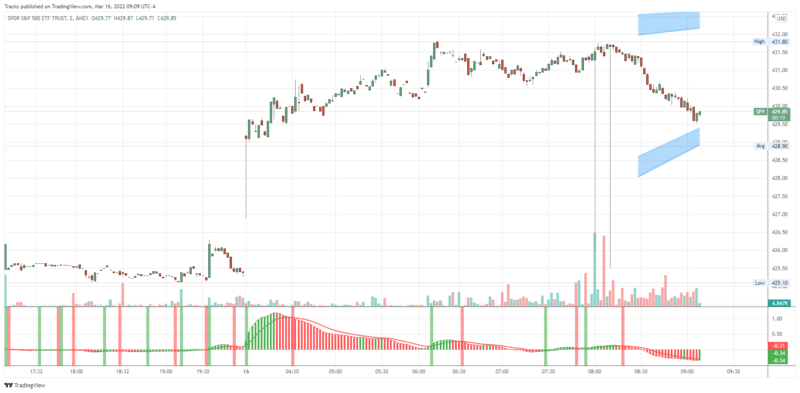

As Powell started speaking yesterday, the market got a pop which lead to a day long melt up. SPY is back in the 439 area, where we have been anticipating resistance. However, now it has more support and confirmation from high timeframes, so don’t let your emotions lock you in to thinking it MUST go down. Key levels to watch are 440-441. …

- Load More