tsheff410

Community MemberSteve posted an update 10 months ago

OP Lotto/ Contest Combo

All that participate in todays

Contest will own equal share of this OP Lotto ticket for $575 Million tonight!

Be the first to guess the exact close of NVDA tomorrow or be closest within .04 and win the

Ace Of Spades OP Engraved Bottle of Champagne PLUS $800 off OP Lifers*.

First to email the closest guess will win…

Steve posted an update 10 months ago

Pro Tips for OP App/Site usage…

Be sure to regularly clear cache as our platform pushes a ton of data to your devices. Clearing cache will speed up the loading and keep things running smoothly.

Be sure you have our app! The links are in your welcome email! Ask for another email if you deleted or didn’t receive.

Close app after every use – this…

Steve posted an update 10 months ago

It’s that time again! Looking for 12-14 OP members that want to play in this years fantasy football league within OP. $200 per team with weekly payouts for high score. EMAIL ASAP to secure your spot so we can plan draft.

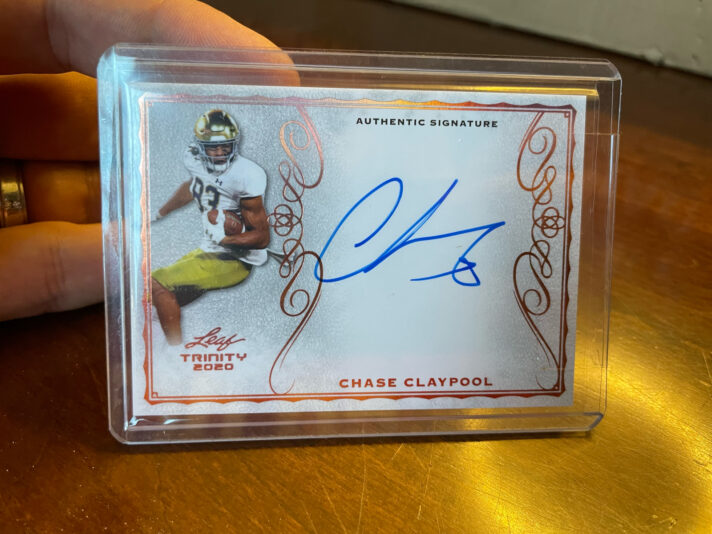

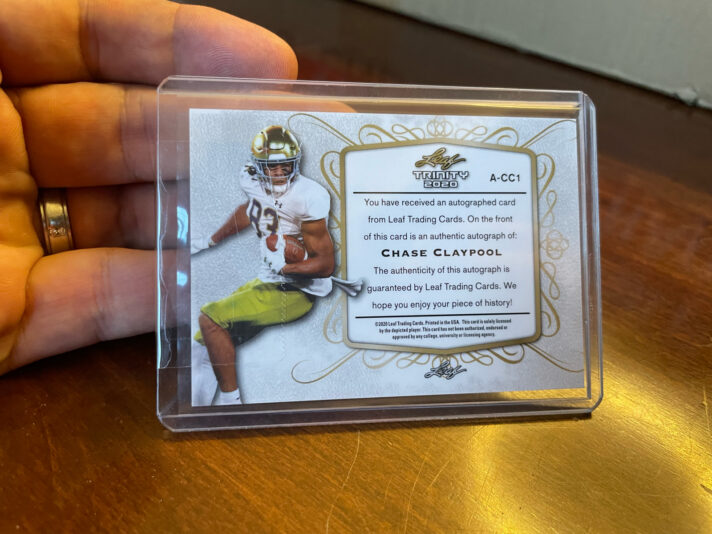

Ill be adding to the top three prizes to include OP Bucks, OP Swag, and sports collectibles!

Steve1 CommentSnake (will randomly draw for draft order

Steve posted an update 10 months ago

Why Adding an Additional Revenue Stream Like Trading is Key to Retiring Early

If you dream of retiring early and savoring the most precious resource in life—time—then it’s time to consider adding an additional revenue stream. Traditional income paths are rarely designed for early retirement. Even if you feel successful in your current career, the…

- Load More