vijayb

LiferTracks posted an update 3 years ago

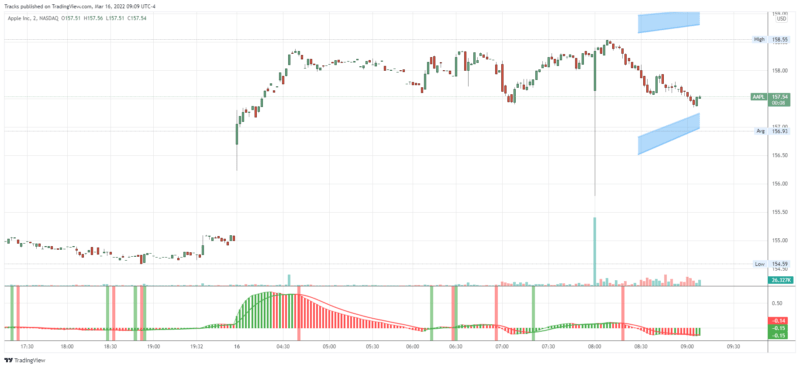

SPY continued up this morning as mids carried primary timeframes into bullish cycles, as discussed yesterday. The gap up this morning gets SPY to the 430 target (which was 428 yesterday). If the Feds continue with the 0.25 interest rate hike and don’t change any plans, I expect the market to continue up (Also barring bad news from…

Tracks posted an update 3 years ago

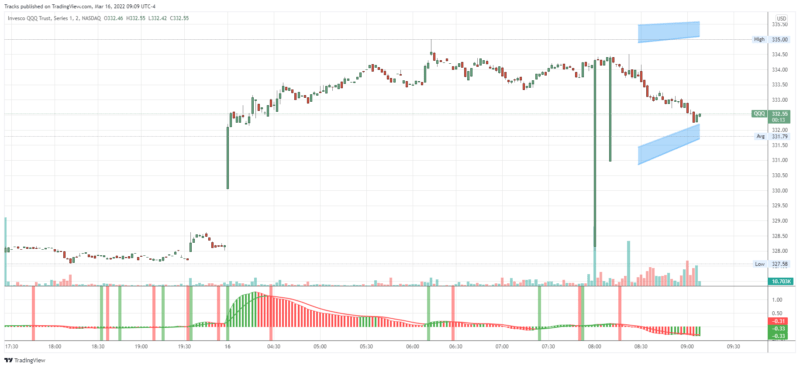

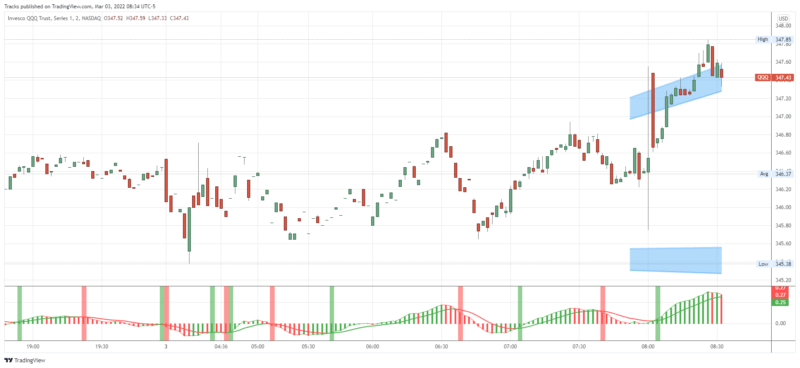

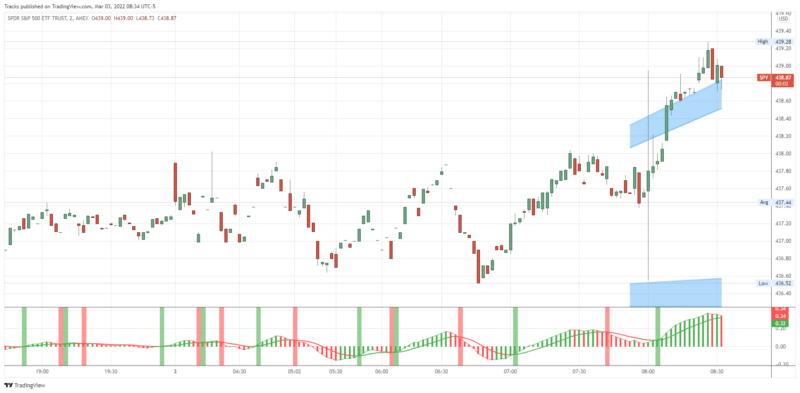

As Powell started speaking yesterday, the market got a pop which lead to a day long melt up. SPY is back in the 439 area, where we have been anticipating resistance. However, now it has more support and confirmation from high timeframes, so don’t let your emotions lock you in to thinking it MUST go down. Key levels to watch are 440-441. …

Tracks posted an update 3 years ago

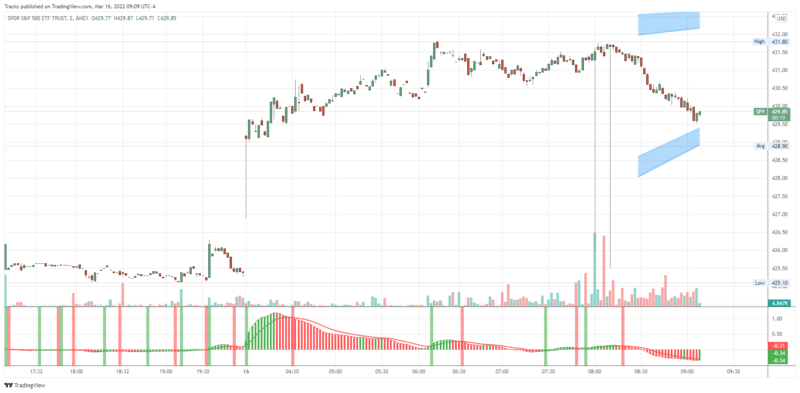

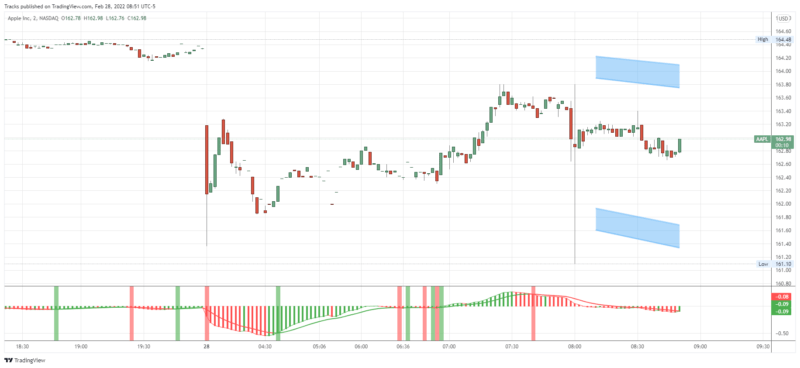

SPY spent the last two days of last week pulling back up after hitting new lows. Based on fib retracement, the 439 area is idea for it to reject and make a new leg down. It hit that area Friday afternoon, and we are gapping down this morning, however I’m cautious about this movement for now. Today is the end of the month, and that may come…

Tracks posted an update 3 years ago

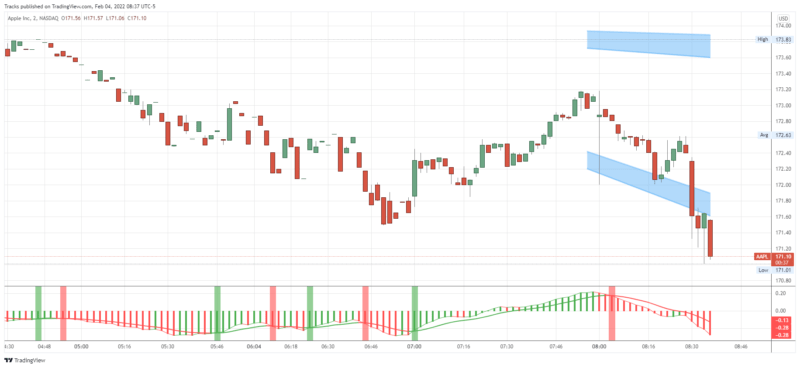

Folks, the word today is caution. Things could be very volatile today and there is no shame in sitting out if you don’t feel comfortable. Certainly do not force trades today. Overall trend for SPY is obviously still bearish, but anything could happen after this tremendous dip. I’ll once again be watching secondary and mid level timeframes…

Tracks posted an update 3 years ago

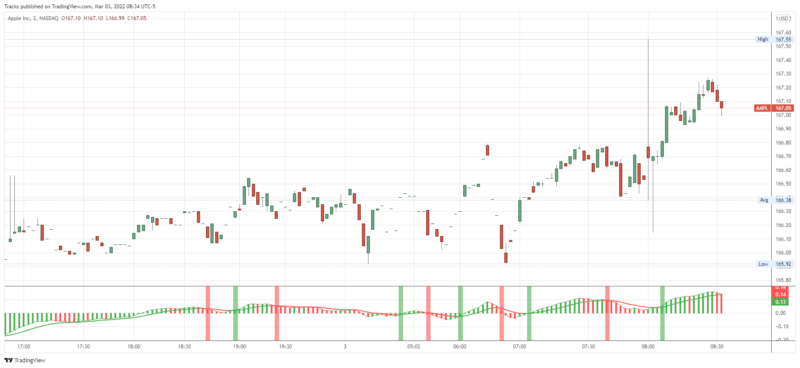

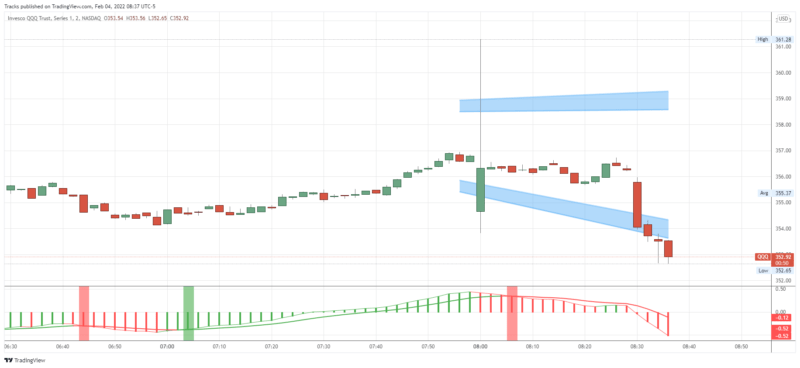

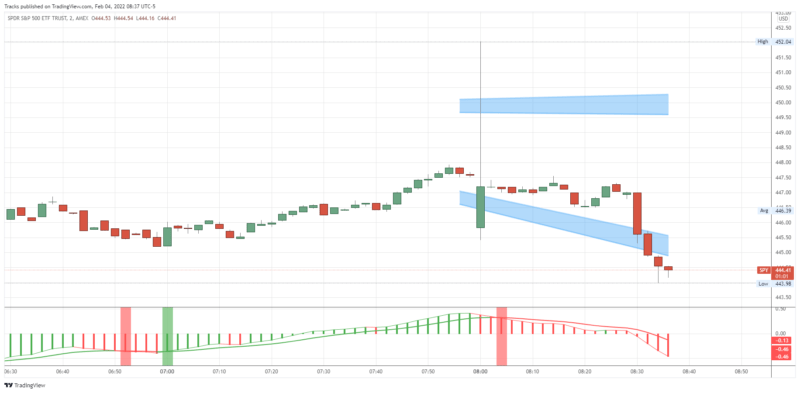

SPY got a little bump with the AMZN ER last night, but dropped back down in pre-market today. The daily 200SMA is lining up with the next level of Primary support at 443.15, so that’s our next target, then 437.85 below that, but we’re getting into a decision point. From here, it’s possible that SPY could turn bounce based on the fib…

KingJulien1 CommentYou meant SPY is testing support in the 445.65 area?

- Load More