Varun Munjal

Community MemberSteve posted an update 10 months ago

Unlock Success with Proven Trading Systems and Community Support

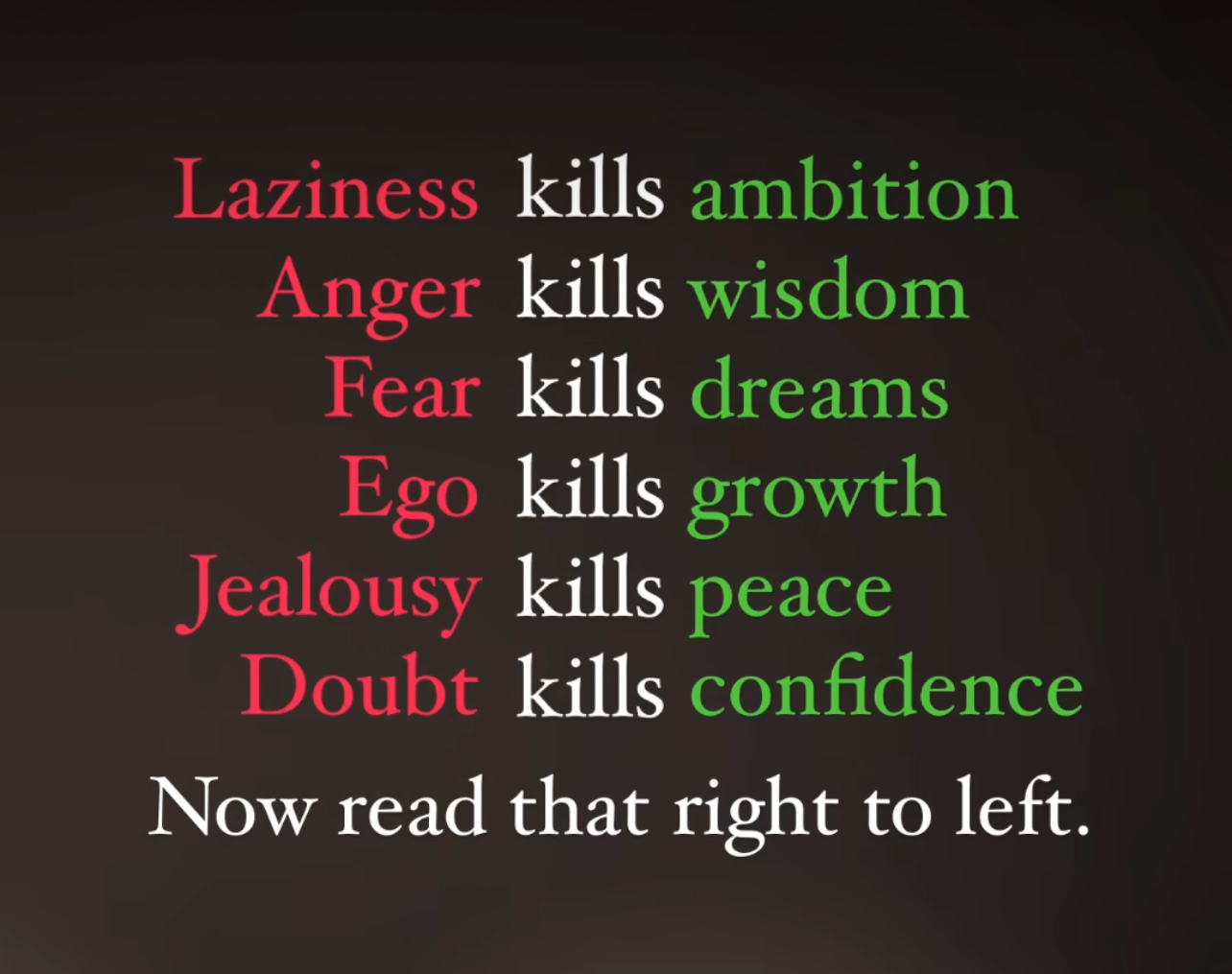

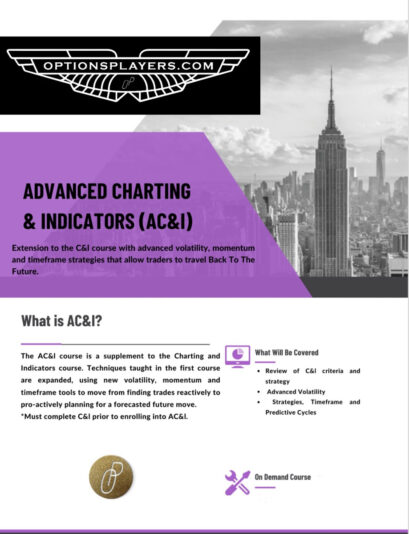

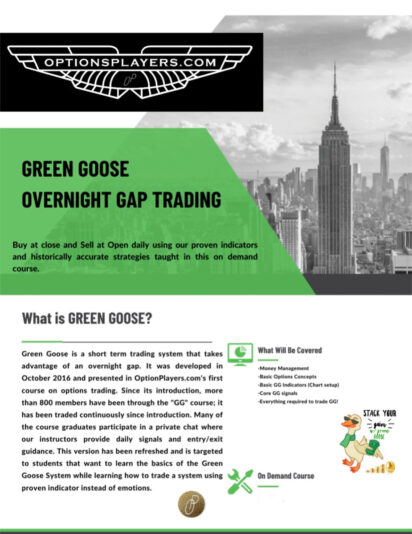

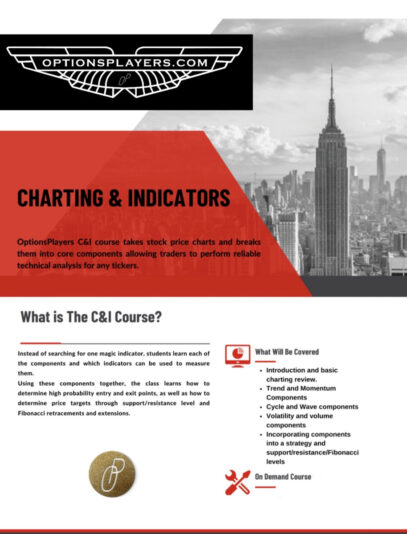

At OptionsPlayers, we believe in trading with purpose, not chance. Using a proven system—like Secret Sauce, AC&I, Green Goose Overnight Gap Trade, or Swing Trade Strategies—offers powerful, high-probability opportunities for success. These strategies aren’t just about picking…

- Load More